ESG information for analysts

This section provides analysts and rating agencies with an overview of all Helaba's ESG-related data.

Strategies and programmes

Acting with sustainability in mind lies at the very heart of our strategy and we have systematically aligned our business activities towards this approach. Our actions are based on fundamental values that ensure sustainable and long-term success. As we look ahead to the future, we are guided by our strategies and programmes in pursuing our goal of making a positive impact on the world around us.

Guiding Principles / Processes / Policies

As a company, we believe it is our fiduciary duty to take responsibility for protecting the environment, society and the lives of this and future generations. With our Guiding Principles and Processes, we ensure that sustainable practices are firmly embedded throughout our organisation and that they are part and parcel of our day-to-day activities.

Sustainability in our core business activities

- 06.01.2026Sustainable Lending Framework 2026

Sustainable Lending Framework 2026

2026_sustainable-lending-framework_kurzversion_en.pdf - 14.03.2025Sustainability criteria in lending activities 2025

Sustainability criteria in lending activities 2025

sustainability-in-lending-2025.pdf - 03.06.2024Helaba Impact and Allocation Reporting 2024

Helaba Impact and Allocation Reporting 2024

impact__allocation_reporting_june2024.pdf - 07.02.2024Sustainable Investment Framework

Sustainable Investment Framework

helaba-sustainable-investment-framework-short-version.pdf - 06.06.2022Second Party Opinion Sustainable Lending Framework

Second Party Opinion Sustainable Lending Framework

second-party-opinion-iss-slf-final-en.pdf

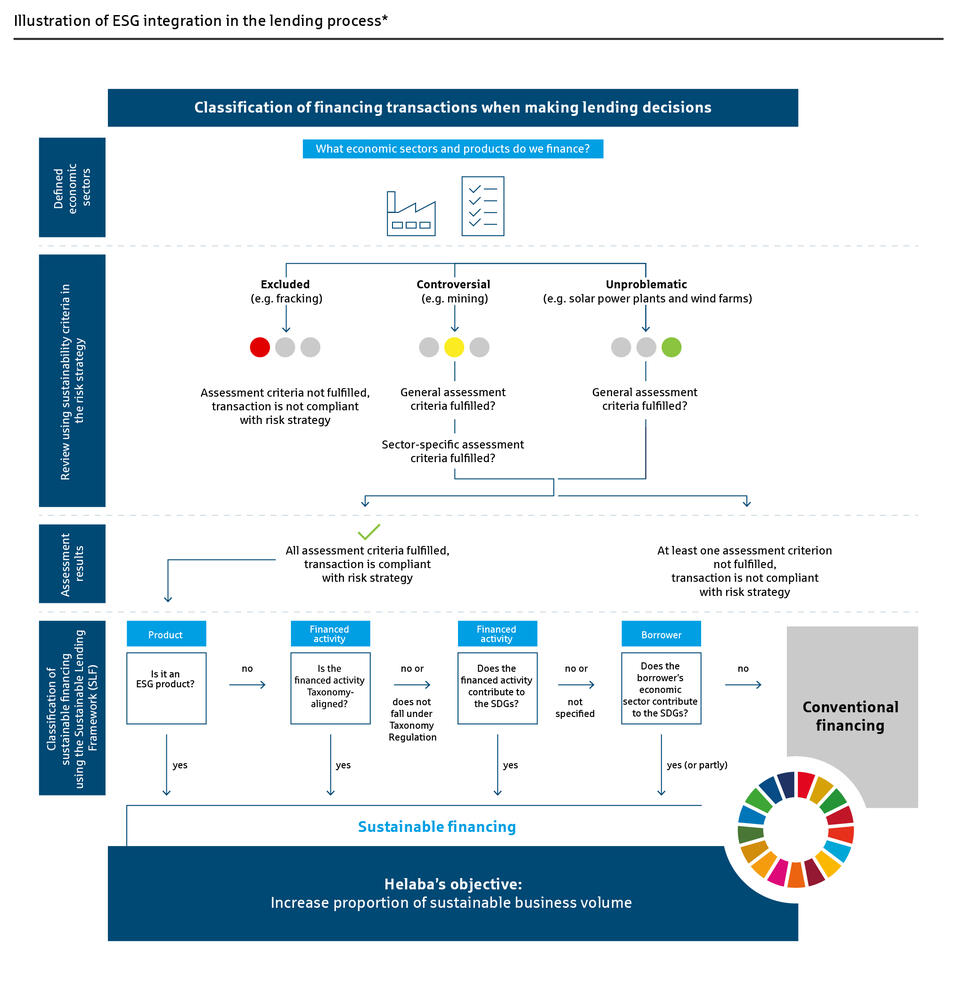

Our ESG integration in the lending process

Corporate Citizenship

Beyond our core business, we are committed as a corporate citizen to society.

- Code of Conduct 2024

Code of Conduct 2024

Human rights and supply chain

Our holistic view of the supply chain for the respect of human rights.

Data protection notices

All data protection notices regarding the processing of your personal data by Helaba.

Governance

The tax strategy is embedded in Helaba's business strategy and risk strategy and is a binding guideline for Helaba. It contains guidelines, objectives and targets for the implementation of corporate governance with regard to taxes (tax compliance governance).

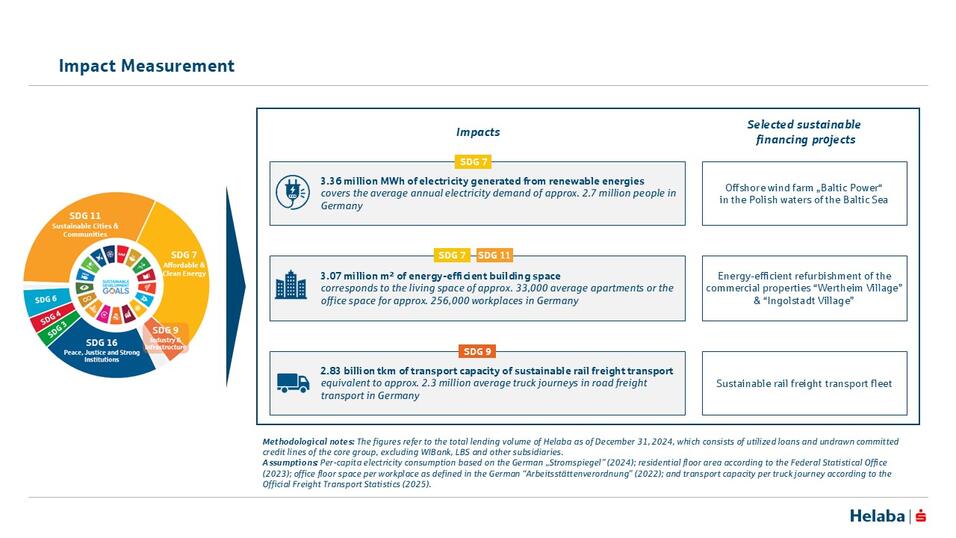

Impact Measurement

Building on its Sustainable Lending Framework, Helaba has developed an impact measurement approach that makes the concrete effects of sustainable financing measurable and transparent. The impact measurement focuses on the key areas of the sustainable lending portfolio: renewable energy, energy-efficient buildings, and sustainable mobility. Through these financings, Helaba contributes to the United Nations Sustainable Development Goals (SDGs), specifically to SDG 7 (Affordable and Clean Energy), SDG 9 (Industry, Innovation and Infrastructure), and SDG 11 (Sustainable Cities and Communities).

The methodology is aligned with the market standards of the International Capital Market Association (ICMA) and is based on data from Helaba’s transition plan for a climate-neutral lending portfolio.

ESG publications

Sustainability is an integral component of the Helaba Group's overall business strategy. Our ESG publications document how we meet our local and global, as well as our environmental and economic, responsibilities.

Sustainability report 2023 als PDF

All information on the sustainability of the Helaba Group for the year 2023.

- 03.07.2024Helaba Sustainability Report 2023

Helaba Sustainability Report 2023

sustainability-report-2023.pdf - 28.06.2023Disclosure Report 2020 3rd quarter

Disclosure Report 2020 3rd quarter

disclosure-report-2020-3rd-quarter.pdf

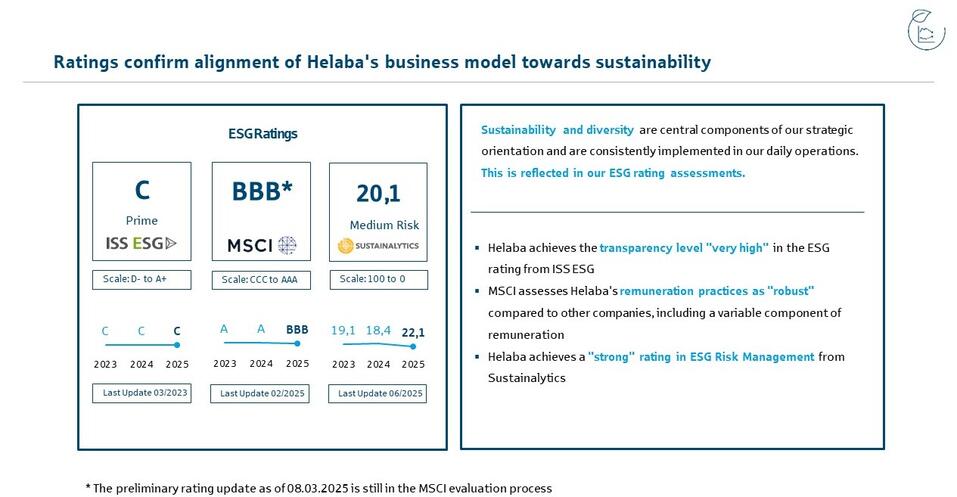

Ratings

To ensure transparency and facilitate access, we provide you with the most important information on our ESG ratings from the selected agencies on our website. The agencies ISS ESG, MSCI ESG and Sustainalytics were selected for our communication strategy due to their leading role in the area of ESG ratings. Their ratings also serve as a reference for the achievement of our KPI5. ESG ratings are not commissioned by Helaba. More detailed information on the significance and methodology of the ratings can be found on the websites of the respective agencies.

UN Principles for Responsible Banking (PRB)

UNEP Finance Initiative

Reporting and Self-Assessment Februar 2025

Initiatives / Memberships

Support for goals of the Paris Agreement is integrated into Helaba's ESG targets. Our Sustainable Lending Framework also takes the UN Sustainable Development Goals (SDGs) into account. As a member of leading ESG initiatives and together with other equally committed companies and banks, we seek to make a significant contribution to achieving these goals.

ESG in the Helaba Group

We provide sustainable products and solutions that address environmental, social and governance issues throughout the Helaba Group and in all areas of our business activities. Our sustainability programme, HelabaSustained, has been rolled out across the Helaba Group with all its affiliated companies. In this section, you can find ESG information and documentation for all of our subsidiaries.

ESG history of the Helaba Group*

Promoting the common good and protecting natural resources have been an integral part of our corporate culture for nearly 200 years. We have been active in the field of sustainability for several years and has gained momentum, particularly since 2020.

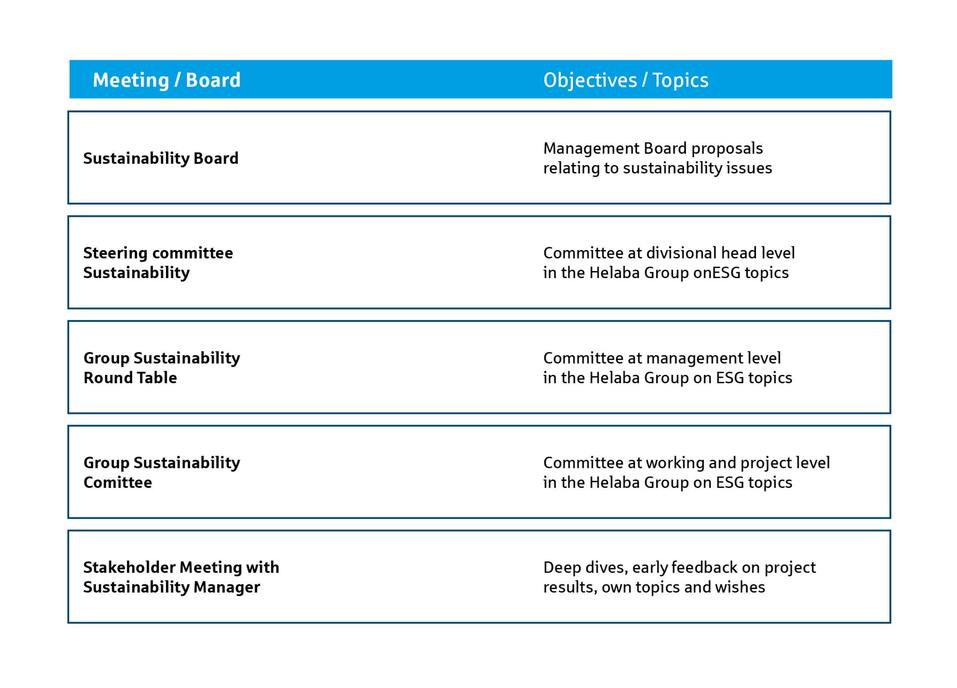

ESG Governance

Press releases

- 08.02.2024First time ever: Helaba and vc trade achieve complete digitalisation in the Schuldschein market

First time ever: Helaba and vc trade achieve complete digitalisation in the Schuldschein market

- 27.07.2023Helaba acts as Sustainability Coordinator on Forvia’s 500 million Euro sustainability-linked term loan

Helaba acts as Sustainability Coordinator on Forvia’s 500 million Euro sustainability-linked term loan

- 07.10.2022"So that good ideas take wing" - Helaba to publish sustainability report

"So that good ideas take wing" - Helaba to publish sustainability report

LBS Hessen-Thüringen

LSB is committed to sustainable sports and club development in line with the 2030 Agenda. It supports sports clubs, sports associations and professional associations in the implementation of sustainable measures, such as energy savings, social projects and environmental initiatives

WIBank

It is an economically and organizationally independent, legally dependent institution within Helaba.

Frankfurter Sparkasse

As a regional market leader in retail banking, FSP promotes sustainable financial products and supports local projects that contribute to social and ecological development. With 1822direkt, it has a strong presence in the direct banking sector.

Helaba Invest

In its core business area of asset management, Helaba offers institutional investors a wide range of professional asset management services. Helaba Invest provides fund products that consider sustainability aspects such as ethical standards and risk management. It supports the transformation towards a climate-neutral economy through selected measures.

Frankfurter Bankgesellschaft

The FBG integrates sustainability into its investment decisions and offers sustainable investment products that consider ethical standards and climate-related issues.

GWH Immobilien Holding GmbH

GWH focuses on sustainable construction and renovation to reduce energy consumption and minimize CO2 emissions. It also promotes social projects in its residential neighborhoods.

OFB Projektentwicklung

The OFB places a strong emphasis on sustainability in all aspects and incorporates not only ecological but also social aspects into project development.